Western Union Netspend – Western Union Netspend prepaid master cards are cards that will give access to the money transfer services by Western Union. Money transfer has always been a risky part of all routine financial transactions.

Western Union Netspend Prepaid MasterCard – Activate Card

So how about a prepaid card that has all the features of a Debit card. Definitely a go-for option for any person making money transfer on regular basis.

But many people are short of knowledge about the Western Union Netspend prepaid cards. If you are one of them you are on the right page.

As we in this article are here to help you upgrade your details about The Western Union Netspend Prepaid Cards. Do read the article till the end for complete knowledge.

About Western Union Netspend Prepaid Cards

Western Union Netspend Prepaid Cards are the combination of the power of a Netspend card with Western Union worldwide money transfer.

Western Union Netspend Prepaid Cards are feature-rich financial solutions that will help you manage your money.

Western Union Netspend Prepaid Cards has all the features of debit cards along with the additional benefit of sending and receiving money from wherever you are.

You can send and receive money for more than 200 countries and territories.

Benefits of Western Union Netspend Prepaid Cards

- Get paychecks, government benefits, and others 2 days faster with direct deposit.

- No credit check, late fees, or interest payments.

- Has more than 130000 reload locations and is thus very convenient.

- Cardholders can set up alert notifications through mail or message about money transfer, reload, location, etc.

- No minimum balance is required to keep your account active.

- You can send and receive your money with just a snap through the Western Union Netspend mobile app.

- Get an option for the custom card with your photo so people can easily know it’s you.

- Also, get an interesting option like a reduced monthly fee plan.

How can you activate Western Union Netspend Prepaid card

Like all other cards, this card also needs to be activated before being put to use. Though the process of activation is no big deal people may have problems with the activation.

You can activate your card through the following process:

- Activate your card with the mobile application.

- Activate via phone

- Activate your card through an online portal Let us see the above methods in detail.

Activate your card with a mobile application

- Download the Western Union Netspend application

- Now on the screen, you can see Activate card option click on that.

- Enter your card number and security code and click on the continue button.

- Now you need to set up your username, password, re-enter to confirm the password, and answer a security question.

- Again click on the continue button.

- Next step you will have to create a PIN and confirm the PIN number.

- Enter your date of birth and SSN (social security number) to confirm your identity.

- Now you will have to select some multiple-choice questions and then you are done.

- Congratulations! Your card is now activated.

Activate your card via phone:

- Call on the Western Union Netspend Prepaid Cards activation number 1-800-214-5483.

- Once your call is connected listen to the operator carefully.

- Provide all the required information.

- Make sure you provide accurate and correct information.

- The operator will deal with the process now.

- Congratulations! Your card is now activated.

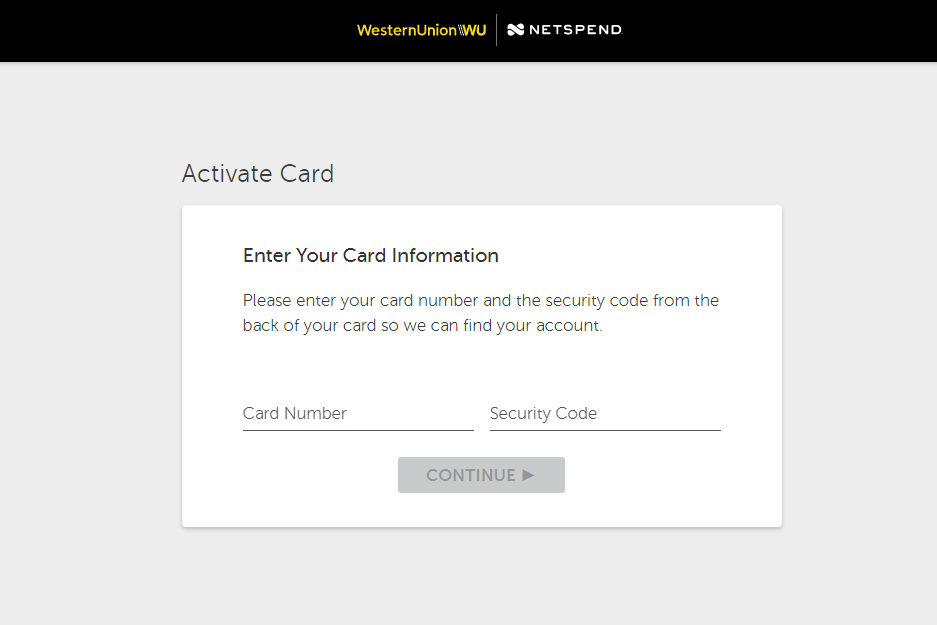

Activate your card through an online portal.

- Visit the official portal for Western Union Netspend Prepaid Cards www.beginactivation.com

- Enter your card number and security code

- Follow the further instructions for activating your card.

About Western Union and Netspend

The Western Union Company is an American worldwide financial service and communications company with its headquarters in.

Denver, Colorado, United States. It has been in the financial industry for more than 170 years now.

Netspend is a Global Payments Company and registered agent of The Bankcorp Bank, Meta Bank, N.A, and Republic Bank and Trust Company.

It provides feature-rich cards that let you manage your money in smart ways. Netspend serves more than 10 million customers.

Western Union Netspend Prepaid Cards is a result of the partnership between both the above-mentioned companies.

Related Same Post –

- Fortivacreditcard.com

- www.cardholder.comdata.com

- www.citicards.com Login

- Get Chase Slate Credit Card

- Macy’s.com/Activate

Conclusion:

This was all about The Western Union Netspend Prepaid Cards which are feature-rich cards with additional service of money transfer.

Some fees may be assessed by reload locations and may vary from location to location. Custom card fees will be applicable and if lost or stolen resubmission of the picture will be required.

You can take control, of your money through anytime access by the Online Account sector, Mobile Apps, Anytime alerts.

Hopefully, this information was useful to extend your knowledge about the Western Union Netspend Prepaid Cards.