Netspend.com/Activate – Netspend company was founded by the Sosa brothers in 1999. After the foundation, Netspend saw achieving many milestones in its progress growth like a partnership.

Netspend.com/Activate – Netspend All Access Activate

with Paypal, Partnership with 7-Eleven, Walmart, WesternUnion, ACE Cash Express, and many more to come in the future as well. Currently, now Netspend is a Global Payments Company.

After getting your card envelop you need to activate the card within its expiration duration that is mentioned in envelop.

How to activate NetSpend prepaid debit card is very easy if you are facing any issue then you can know how to do that thing below

Mentioned activation process type and explanation step-wise so that you can easily follow step by step process.

How to activate the prepaid card on Netspend.com/Activate

After getting your new prepaid debit card you need to do activate it within seven to ten days so that you can enjoy the benefits of this card via Netspend.

To activate this card you have two options either you can go for the online process or you can choose the activate via phone.

From both ways, you can activate your card it totally depends on you which method is okay for you.

How to Activate NetSpend Card Online?

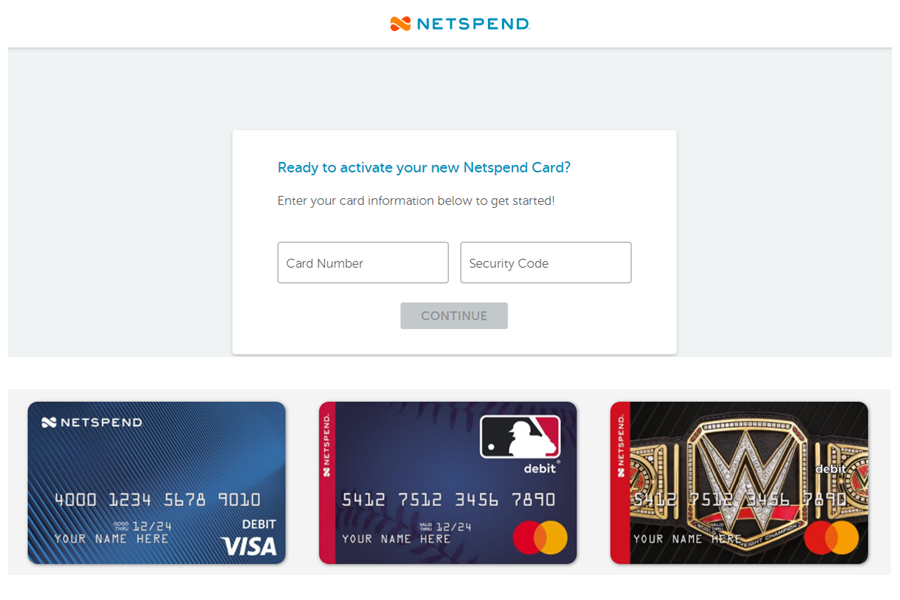

- Visit the Netspend.com/activate official website.

- When the website loads then click on activate card option.

- After then it will ask you to enter your card and security code.

- After filling in information click on the continue button and your card will be activated after confirmation.

How to Activate NetSpend Card on the Phone?

- In the card envelop that you received, check that you will find one phone number over there.

- Call on that phone number and the Netspend card support guy will lead you to activate the card.

- If you don’t have that envelop with you or are not able to find that number then also you can find that number on the official website is Netspend.com/activate

- Also, you can call the customer service number for same: 1-866-387-7363.

How to Request NetSpend Visa Card Online

If you like the benefits of Netspend card and want one for you then you can easily get one by doing the below process:

- Go to https://www.netspend.com/card-order/ve/netspend/

- Fill the whole form of applying to prepaid debit card of Netspend

- After filling all fields and choosing what type of card you need click on the get my card button and it will lead to the next steps

- After receiving the card envelop you can activate your NetSpend prepaid debit card by doing above mentioned methods.

Netspend FAQs

- Question: After receiving my card what should I do first?

Answer: After receiving your card you should first activate it. On icardactivate.com we have explained to you how to activate your NetSpend card online as well as by phone also.

- Question: How can I get my Netspend card?

Answer: You can get your Netspend card by filling the online form with correct details on https://www.netspend.com/card-order/ve/netspend/

What are the benefits of the NetSpend Prepaid Debit Card?

There are many benefits of having a Netspend prepaid debit card as it has partnerships with big shopping brands and as well as it is now a global payment method.

- Load your card.

- By app and web panel you can control your money.

- It has much exciting cashback and offers on transactions.

- Security is the main and core feature.